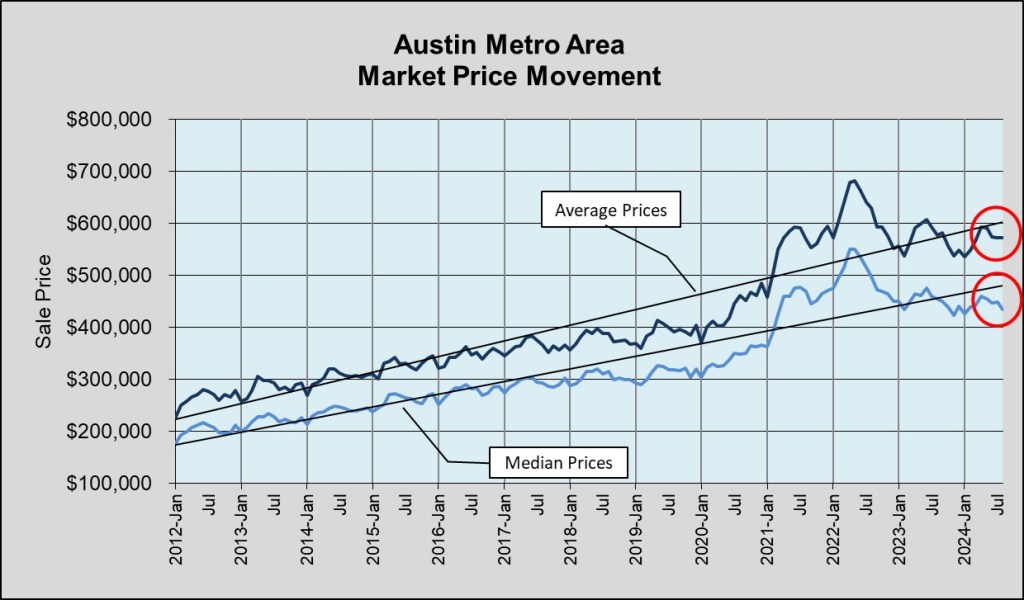

In Latest Data on Austin Residential Market Trends, I commented that home prices in our metropolitan area have been down in recent months and remain far below the peak we saw in 2022. In contrast, Yahoo!finance published this article this week:

To the moon! Case-Shiller home price index hits another record high

This paragraph summarizes:

“Home prices have reached yet another all-time high, but the pace of growth is slowing. That’s according to the S&P CoreLogic Case-Shiller Index for July, which shows U.S. home prices rising 5% year over year. Growth in major U.S. cities was even higher, as the 10-city composite index was up 6.8% year over year and the 20-city composite index was up 5.9%.”

This chart from the St. Louis Federal Reserve Bank helps to visualize the path of the index for the same period covered by my Market Trends post (minus August 2024):

Yes, I understand that the text in that chart may not be legible on your device (See https://fred.stlouisfed.org/series/csushpinsa for the details.), but the shape and direction of the graph line is clear, and is very different from our experience in Central Texas:

The pandemic-era price peaks are obvious, and I have circled the changes in 2024. Homeowners in the Austin area saw their equity soar in 2022 and 2023, and remain far ahead of where they were in 2020, but this has been a challenging market in search of balance this year.

More to come on this ….

Discussion

No comments yet.