Bill Morris on Austin Real Estate

Latest Post

Builder Price Reductions Impact on Austin Homes

In Understanding the 2025 Austin Housing Market Shift, I linked an article about the impact of price reductions by homebuilders, and the effect it is having on sellers of existing homes. Texas is among seven states where the percentage of builder listings with discounted prices is higher than the national average.

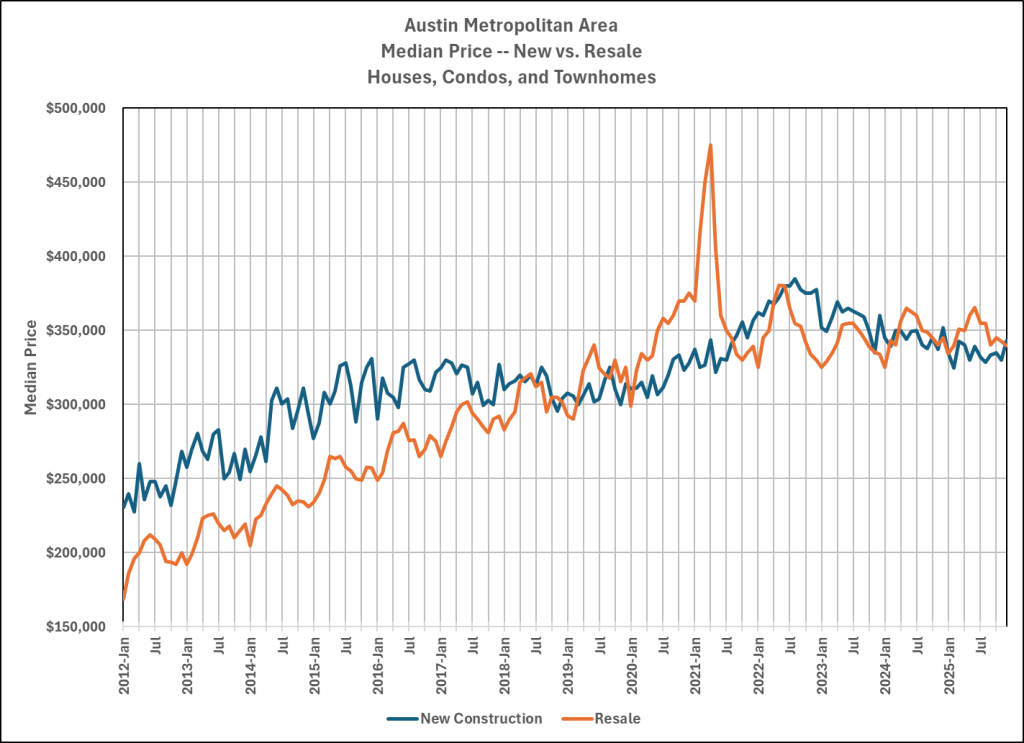

That article dealt with the national situation, but I noted that this relatively new feature of the residential market is especially noticeable in the Austin area. This comparison of median sale prices of new and resale homes makes it clear:

During the first six years of this very long market cycle, builders’ median prices were consistently above those of exiting homes. As I shared in 2025 is complete … here’s the data, listing inventories began to decline in 2019 and buyer competition pushed resales higher. The trend accelerated in 2020 and resale prices skyrocketed. Builders allowed their prices to rise as well, but they enjoyed their advantage among frustrated or price-limited buyers. They did capitalize on market conditions in 2021 and 2022, but the field was largely levelled in 2023, and for the past two years builder prices have almost always been lower than resale homes.

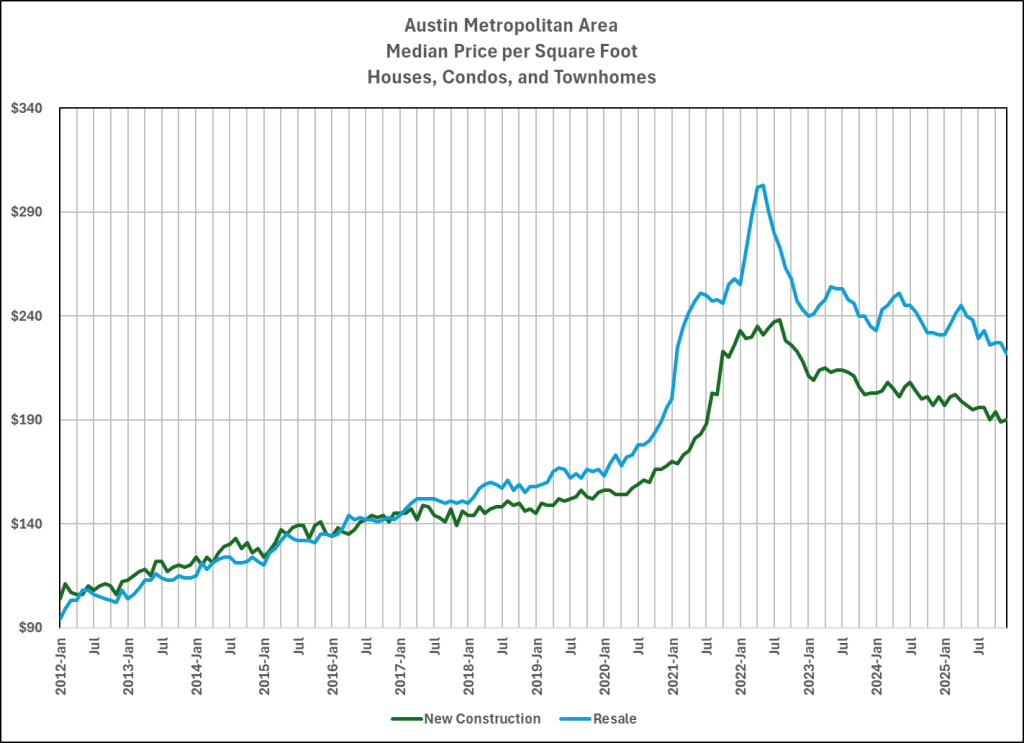

Median Price per Square Foot shows this shift even more dramatically:

In that chart you can see that prices of resale homes began to move higher than new homes in 2018 and 2019 but the gap became really exagerrated in 2019, 2020, 2021, and 2022. It remains a significant force in market dynamics today.

It’s worth noting that the comparisons above are not exactly apples-to-apples. The mix of houses, condos, and townhomes and the floorspace in those homes was not exactly the same among new and resale homes throughout the time shown. In addition, larger homes tend to sell for a lower price per square foot than smaller homes if only because the value of the land underneath them is divided by the larger number of square feet.

It is also important that resale home prices in 2025 (and now) were/are lower than the price peak we saw in 2022, so homeowners who purchased during the past 4 or 5 years are reluctant or unable to lower their prices as needed. With that said, though, this data is too consistent to disqualify based on those variations.

At this point, there is no indication of a major change in this aspect of our Central Texas market, but I will continue watching and reporting on it. Stay tuned here for complete updates on the Austin metro market environment.