Bill Morris on Austin Real Estate

Latest Post

2025 Resale Results

In Happy New Year — a look back I shared an article that summarized our experience in Austin-area residential real estate last year. Final data from the Texas Real Estate Research Center will be available in a couple of weeks, but using our MLS system we can look more closely at activity involving existing (resale) homes and provide some historical context.

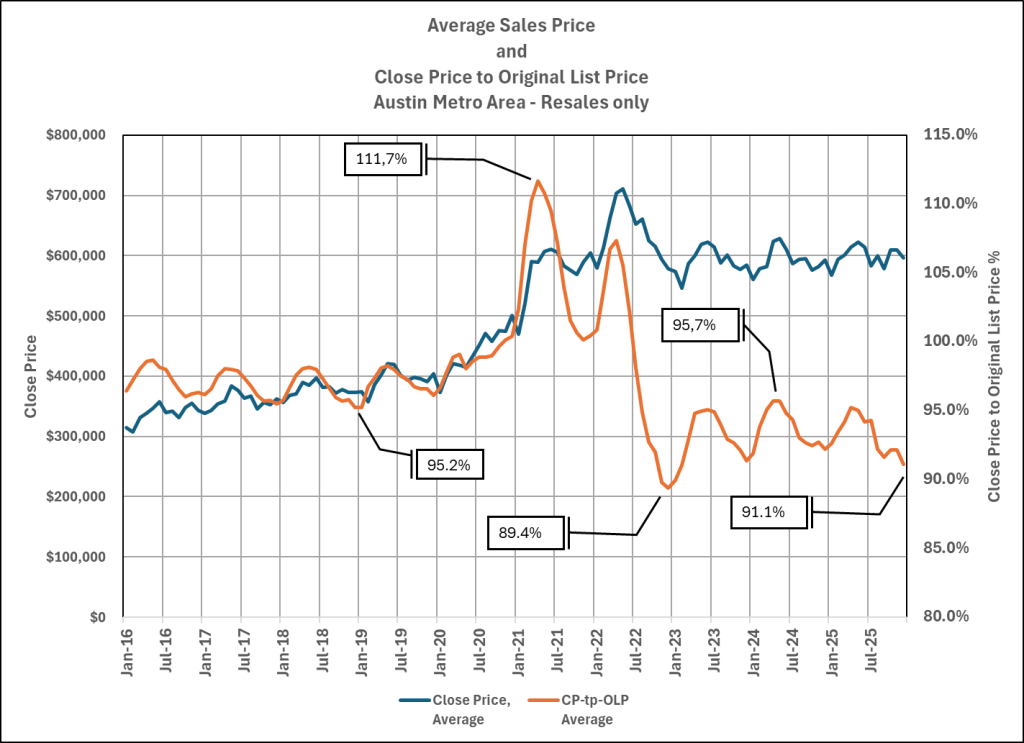

First, this chart shows what home sellers and buyers were most aware of in 2025, and how home prices compared to the previous nine years’ experience:

The first peak of demand was in April 2021, when the average final sale prices were almost 112% of the original list prices of the properties sold. Those bidding wars set the stage for frantic buying activity, with list prices soaring, and closing sale prices peaking at $711,056 in May 2022, up more than 16% from June 2021!

Obviously, market dynamics changed dramatically after that, and actual sale prices hovered around $600,000 throughout 2023, 2024, and 2025. Sellers were slow to adjust however. Original list prices for new listings stayed high, and the Close Price-to-Original List Price ratio was below the previous bottom for all of those years, with two exceptions in April and May 2024.

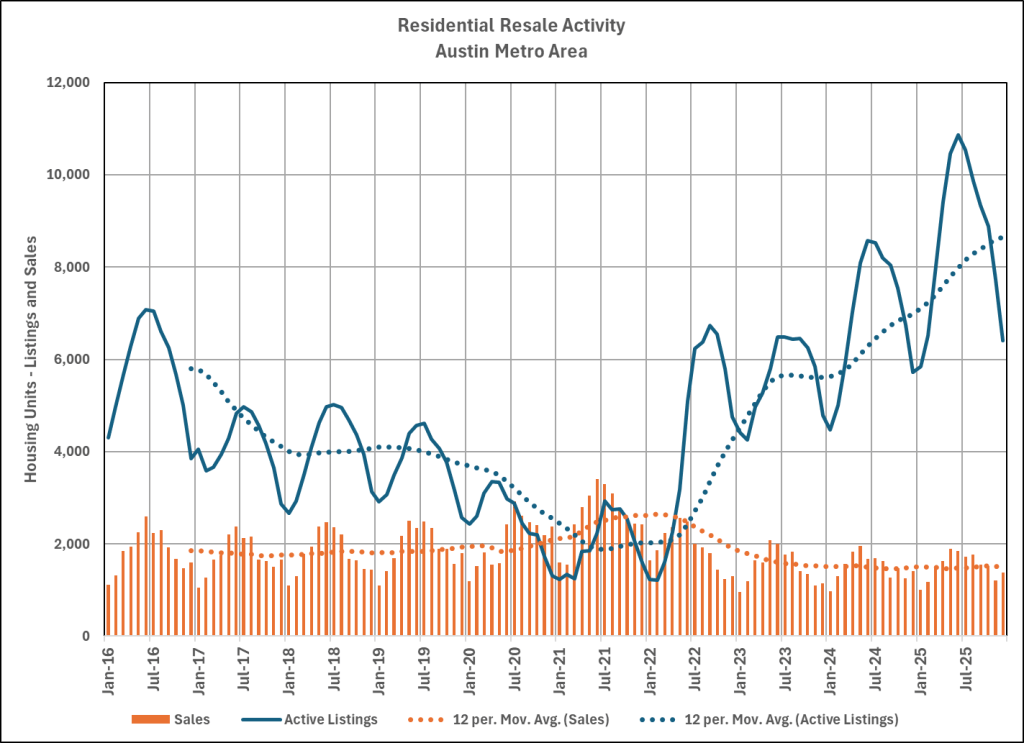

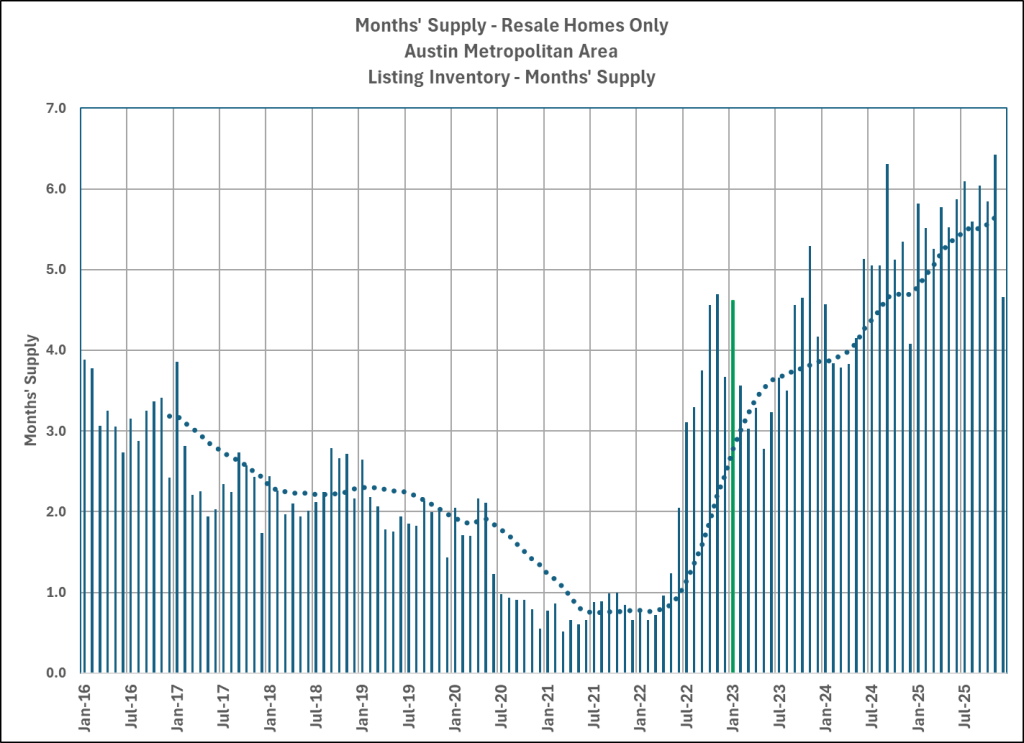

The next two charts describe the market environment that led to the changes in sale prices:

In the first of those charts the sales peak in mid-2021 is visible. In the bottom chart, notice that the Months’ Supply metric fell below 1 month in the Summer of 2020 and remained at that level through the Spring of 2022. The inventory of Active Listings shot up from 1,230 to 6,552 between January and September 2022, while Sales sank and flattened over the following four years. Months’ Supply was near 6 months for most of the past year.

For many years we considered a 6-month supply of active listings to be “normal” or “balanced,” but home buyers spent most of this market cycle watching 3 months’ supply become “normal” and mortgage interest rates in the 3% – 3.5% range allowed buyers to participate that might not have in previous market cycles. With interest rates now twice that level and average sale prices up from about $400,000 in January 2020 to $600,000 now, many prospective home buyers are unable or unwilling to take advantage of the variety of homes available for sale.

There is no reason to expect a sharp change in our market circumstances in the coming months, but I’ll add to this story as 2026 moves forward.