A few weeks ago I published my Austin Market Dashboard covering final data through the end of 2012. I discussed the very low listing inventory in the Austin metropolitan residential real estate market. This is another view of that trend that I believe may make more direct impact on readers. (All data courtesy of the Real Estate Center at Texas A&M University.)

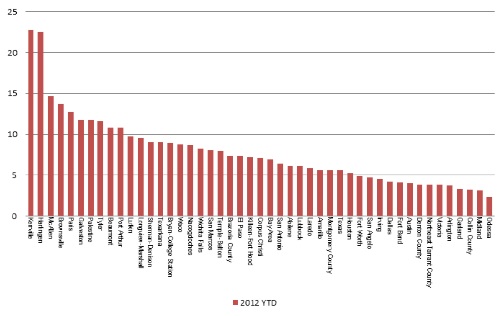

First, look at how home sales growth in the Austin/Central Texas market compared to other cities in the state:

Austin ranked 7th in growth rate, but was the fastest-growing major metropolitan area in Texas — up 20% from 2011 to 2012!

Compare that to the change in the number of homes available for sale:

Austin is much farther to the right on that chart, but listing inventory in Dallas and Houston shrank more quickly last year. The important point for this post, though, is that in the same year when sales grew by 20%, the number of homes available declined by 21%!

The result — dramatically reduced supply:

That graph shows Austin with 4 months’ supply of residential listings. That “YTD” figure is misleading, however. The Austin metro area finished 2012 with 2.7 months’ inventory — less than half the supply generally considered “balanced market” conditions.

The effect of that imbalance — most noticeable during the final months of 2012 — was many multiple-offer situations and increasing home prices. By the end of the year, both median and average prices were up 6% year-to-year.

If you have had thoughts of selling your home in the Austin area, this may be your year to do so. As I have mentioned before, though, inventory and price pressures are not affecting all parts of town the same way. Even today, there are neighborhoods where average prices are flat or down from a year ago, and others where prices have increased much more quickly than the average. Get professional consultation about your specific situation.

Likewise, if you plan to buy a home, this may be your year. Depending on where you want to live and what size/age/style/price market segment you need, you may also find it a challenging and frustrating experience. Don’t just assume that and pay too much for a home. Get preapproved for a mortgage, find out how much you can afford, and hire professional representation to help you with your home search. If you have a real estate professional on your side, consultation on pricing and negotiation will be part of the service.

An important take-away from market data presented here: Residential prices will rise again this year, probably faster than last year. Builders are getting busy again, but it will be almost impossible for most to ramp up quickly enough this year. Depending on their ability to acquire land and get permits, the new vs. resale mix in 2014 could change, and in 2015 it almost certainly will. At the same time, interest rates will likely be on the rise, imposing additional limits on how much buyers and spend and on how much some sellers can charge.

Is it your time to buy or sell? Consult a professional and find out. Either way, we’re in an exciting time for the Austin metro economy and real estate market.

Discussion

Trackbacks/Pingbacks

Pingback: Fast-trackin’ in Austin real estate | Bill Morris on Austin Real Estate - March 8, 2013

Pingback: Austin Market Dashboard, updated thru Feb. 2013 | Bill Morris on Austin Real Estate - March 31, 2013