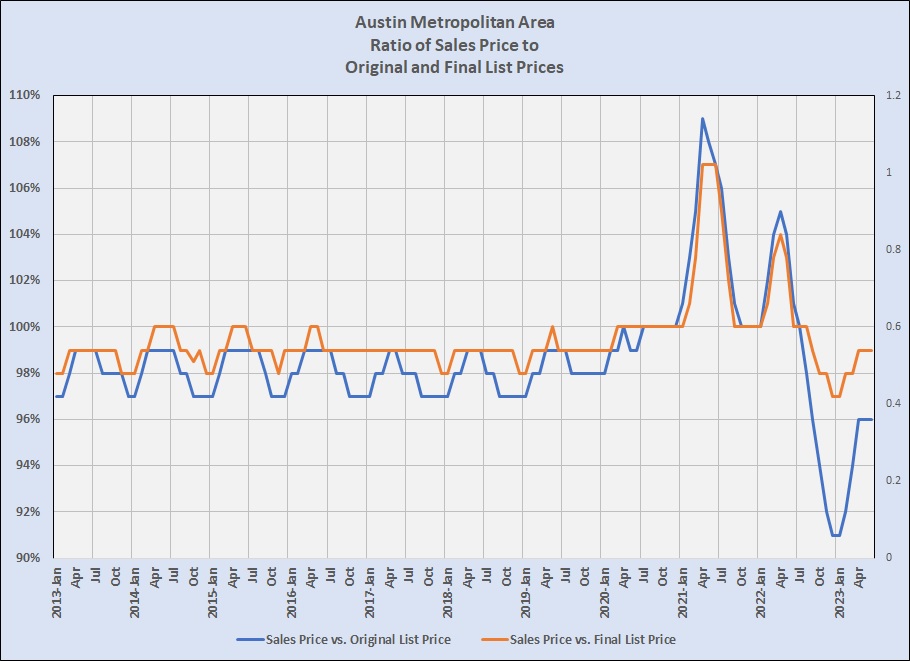

Many times in recent years I have highlighted how different the pandemic era was compared to long history in the Austin metro housing market. I have discussed sale prices, listing inventory, unit sales, and highlighted the fact that for much of the period (20 months, September 2020 through April 2022), we actually sold more homes than we listed every month. In this post I add a look at price discounts on homes sold throughout this long market cycle:

That chart deserves a little explanation. The blue line shows the ratio of actual sales prices to properties’ Original List Prices. For most of this market cycle, completed sales were at 97% to 99% of their original list prices. Also note that actual sales prices were between 98% and 100% of the Final List Price (at the time the successful contracts were executed). That difference indicates that we saw small price reductions fairly routinely from 2013 through most of 2020.

On average, sales prices were 100% of final list prices from March 2020 through the end of that year, and then soared higher by April 2021! We saw a second spike in 2022, with the ratio of sales prices to original and final list prices above 100% in February through June of 2022, peaking in April. (Those April closings were mostly contracts executed in March.) As buyers and sellers adjusted to the new market dynamic, the environment changed rapidly, and by January 2023 we saw new lows, with the ratio of sales prices to original list prices at 91% and even the ratio of sales prices to final list prices at 97%. We have seen a reversal of that trend since January but both ratios are still lower than in all of the first seven years of this market cycle.

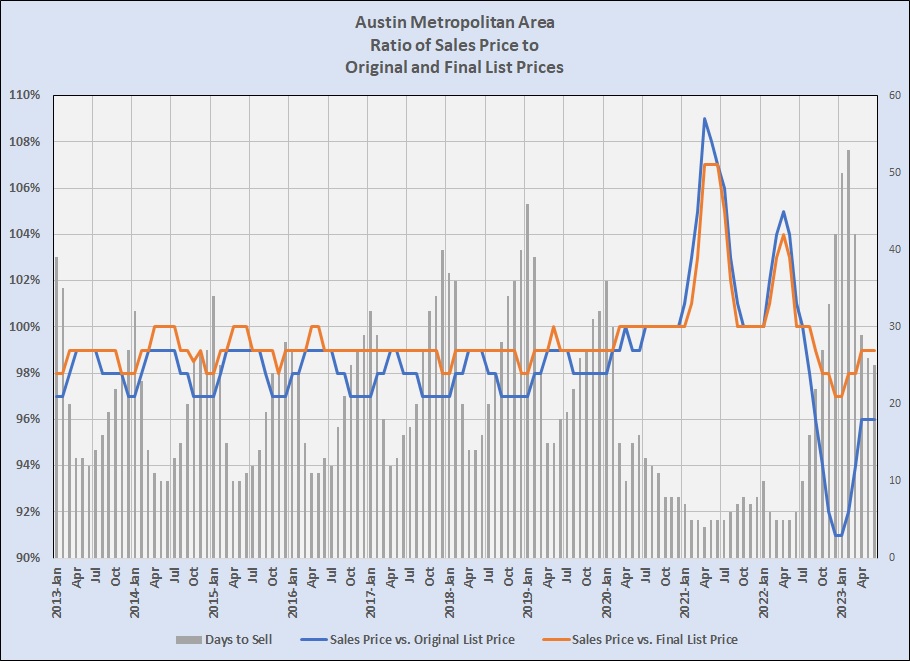

Now, add another important statistic:

The gray bars indicate the Average Days to Sell throughout the market cycle. The seasonal peaks and valleys in 2013 through 2019 were consistently lower than previous cycles, but look at the shift in 2020. As we consumed inventory, unrestrained bidding wars took over. Days to Sell dipped to 10 days in April 2020 and stayed 16 days or lower through August 2022. That statistic hit a low of 4 days in April 2021, stayed mostly in single digits for fifteen months, and then shot up to 53 days in just the eight months from June 2022 to February 2023.

See Market Dashboard – transition toward “normal” for more market details. We have begun to see some inconsistent month-over-month price growth, and inventory is up from early 2022 (but still about half what the industry has considered “normal” in previous market cycles). The market has changed and continues to do so but many prospective home sellers are reluctant to list now because of the uncertain environment, mortgage interest rates that are twice what they were just 18 months ago, and almost twice what they were for most of the past 10 years. Moreover, although sales prices (and property tax values) have generally declined over the past couple of years, they are much higher than they were 5 or 10 years ago, so homeowners with the protection of old homestead exemptions must face very real changes in the cost of homeownership if they move.

At this point, change is the constant in our market environment, and uncertainty is the result. The data in these charts runs only through June. I’ll keep you informed as trends evolve over the rest of the summer and into the school year. Keep the faith …. External forces are at work, but the fundamentals of the Central Texas economy and housing market remain strong.

Discussion

No comments yet.