Two articles added to AustinMarketInfo.com this morning discuss changes and trends in the U.S. real estate industry (Housing Market In Stumble Mode and Home Prices in U.S. Cities Up 3.8% From Year Earlier). As I frequently do, I think it is important to provide an Austin/Central Texas perspective since our local and regional market has experienced the housing downturn and recession very differently than the five states where the worst impacts have been felt.

Both focus on today’s report on the Standard & Poor/Case-Shiller index of home values in April 2010 showed the best year-over-year improvement in more than 3 1/2 years. That index compiles data from 20 cities around the country and provides a point of reference for market watchers. It does not provide a way to judge the market performance over time of any one metro area, particularly one like Austin that is not one of the C-S cities.

For example, looking at Austin in isolation and attempting to compare to the reported change in the C-S index, a casual observer would conclude that Austin is in a weaker position than the indexed cities: the average home price here rose just 1.6% from April 2009 to April 2010, and the median price was essentially unchanged over that period. Obviously, that’s worse than 3.8% growth, right?

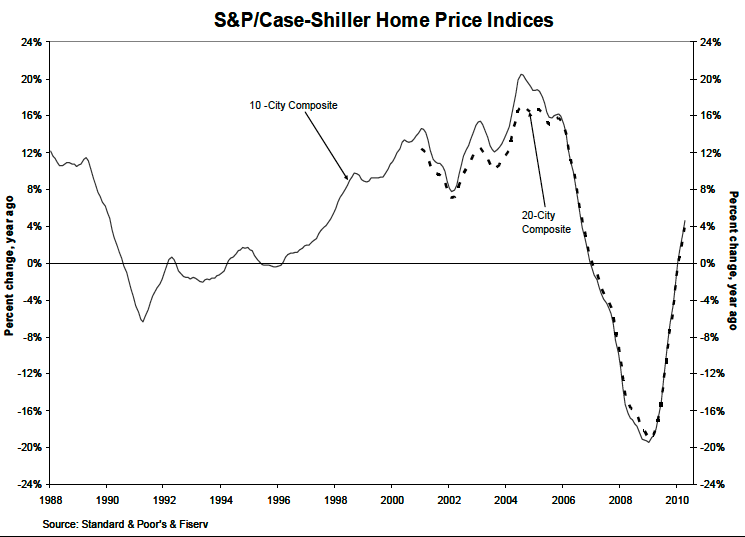

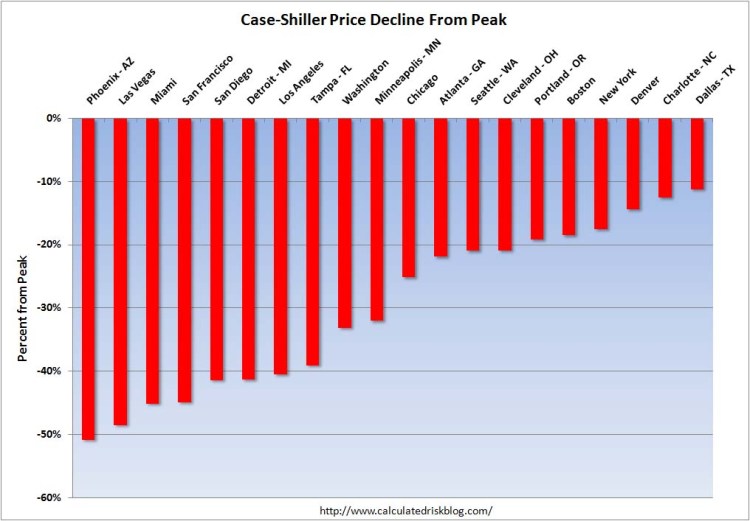

These charts may change that perception:

Any discussion of upward market movement must include a reference to “growth from what?” In the first graph above you can see that the 20-city index in early 2009 was down almost 20% from a year earlier, and down about 35% from the market peak in 2005-2006. The second chart details how far each of the 20 cities fell from the market peak.

Compare that situation to this history of the Austin Metro area:

If you are not able to view those graphs above, they are also linked to PDF versions. Just click the image area to see the related chart. Either way, what you will note is that the Austin Metro area has seen some ups and downs in average home prices since 2005, but we have generally stayed within a range of +/- 8%. Note, too, that the trend in home values over the past 5-plus years has still been up. Our winter markets were weaker than usual in 2008-2009 and 2009-2010, but the direction of change over time is unmistakable.

Moreover, as I have noted a number of times elsewhere in my blog, the Austin/Central Texas area remains a bright spot in terms of job creation, new company formation, and net population in-migration. Two tax incentive programs over the past year have badly distorted real estate market seasonality, so what the summer holds for us is somewhat uncertain. My early analysis indicates that home buyers in our area have continued to execute new purchase contracts even since the April 30 expiration of the last tax credit program, but one or two months does not make a trend. We will know more in another few weeks. I will follow developments and update this page, but my Austin Market Dashboard is always available with up to date monthly data as well.

Discussion

Trackbacks/Pingbacks

Pingback: 2010: BillMorrisRealtor.com in review « Bill Morris' Austin Real Estate Blog - January 2, 2011