A few days ago, REALTOR® Magazine published Could a Real Estate Sales Shift Be Ahead This Fall?, suggesting that after a “lackluster summer … the fall season could breathe new life into the housing market.”

The article continues, “A recent housing report suggests more listings, lower prices and less competition could be coming this fall, making up what realtor.com® calls a prime time for home buyers. Their research identified the week of Oct. 12-18 as offering the best buying window of the year.“

This morning another relevant article appeared in the Austin American-Statesman: Austin’s fall housing market increasingly tilts to buyers, new data suggests. If you are a Statesman subscriber, you’ll be able to read the entire article at that link. If not, here are some highlights:

“In August, the metro area had 131% more home sellers than buyers — one of the widest gaps among major U.S. metros, according to new data from online real estate marketplace Redfin. Nationally, there were 35.2% more sellers than buyers making this summer the strongest buyer’s market in records dating back to 2013.”

“Prices have softened modestly across the metro while holding up better inside the city. Redfin estimates Austin-area prices in August were down about 3.7% from a year earlier and closer to 1% by late September.”

“… the weeks ahead will largely depend on whether mortgage rates continue to ease and how many new listings hit the market. If rates fall further, more buyers could return and narrow the gap between supply and demand. If activity on both sides holds steady, fall should look much like late summer: a more balanced market than the boom years, with a clear edge for prepared buyers — and solid results for sellers who price to the market.”

As I have pointed out in previous posts, average and median home prices in the Austin-area are still below their peak in 2022. (See Austin Real Estate 2025: Market Shift Explained.) It is true that listing inventory has grown in 2025, but that historical perspective is important. Homeowners who purchased during the past few years may well face market prices below their purchase prices, and as they consider moving they also face the reality that mortgage interest rates are about twice what they are paying on their current loans. It is very unlikely that rates will decline enough to close that gap.

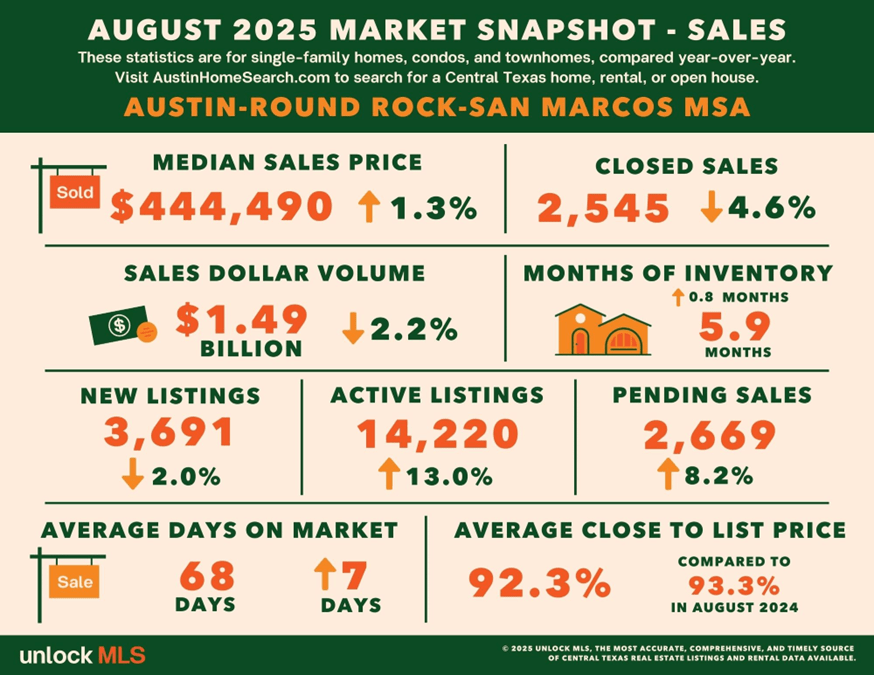

This snapshot of the residential market across the Austin metropolitan area is helpful:

The number of active listings was up in August 13% compared to the year before, and the number of closed sales was down almost 5%. Pending sales were up 8%, but the ratio of close price to list price was 92%, a bit lower than a year prior.

It is a fact that we are experiencing conditions that favor home buyers, but there are still uncertainties that may deter many buyers, and young first-time home buyers are discouraged by prices, even though they’re lower than a few years ago. In many areas, investors are submitting aggressively low purchase offers, and they are finding sellers who are willing and able to say “yes.” Some buyers are indeed buying homes to occupy, and they are doing so at a great time, but the next few weeks and months will tell if it’s enough to overcome the challenges we have seen this year. The market is still sending mixed messages.

We are wrapping up the 3rd quarter of 2025 now, and I will have refined numbers for the month’s activity in a few weeks. I will add my updated comments then.

Discussion

No comments yet.