In my latest e-newsletter (Market Trends Continue) I shared some insights about real estate challenges affecting local and regional markets nationally. Today I have much more information about the broad U.S. environment. Much of it focuses on the role that new construction plays now in the larger residential market, but I want to share a few points here:

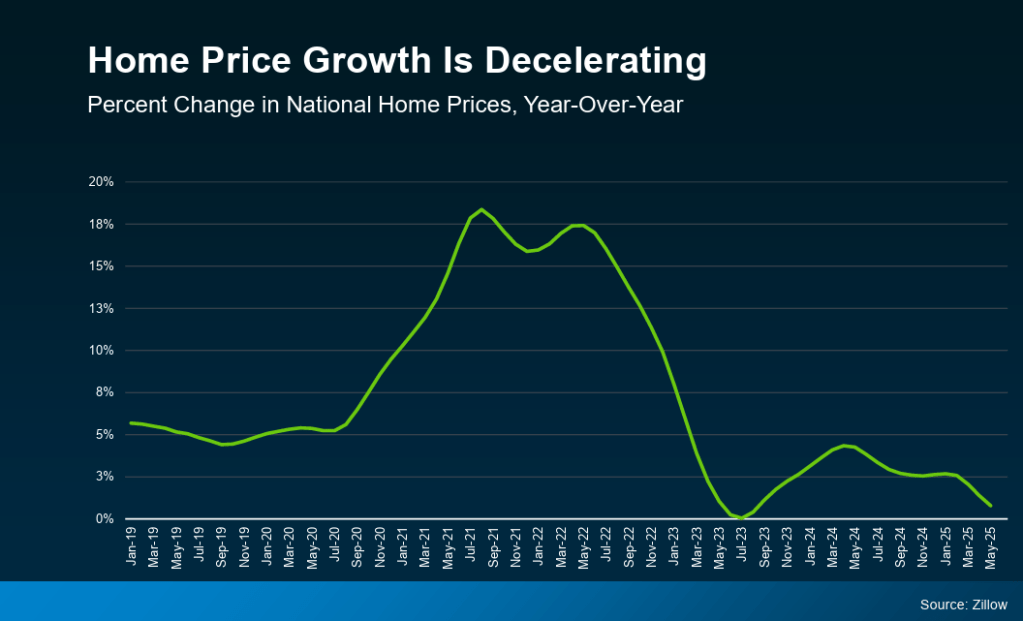

First, with mortgage interest rates and broad economic uncertainties making buyers tentative in their decisions, and with listing inventory dramatically increasing, price growth has largely stalled:

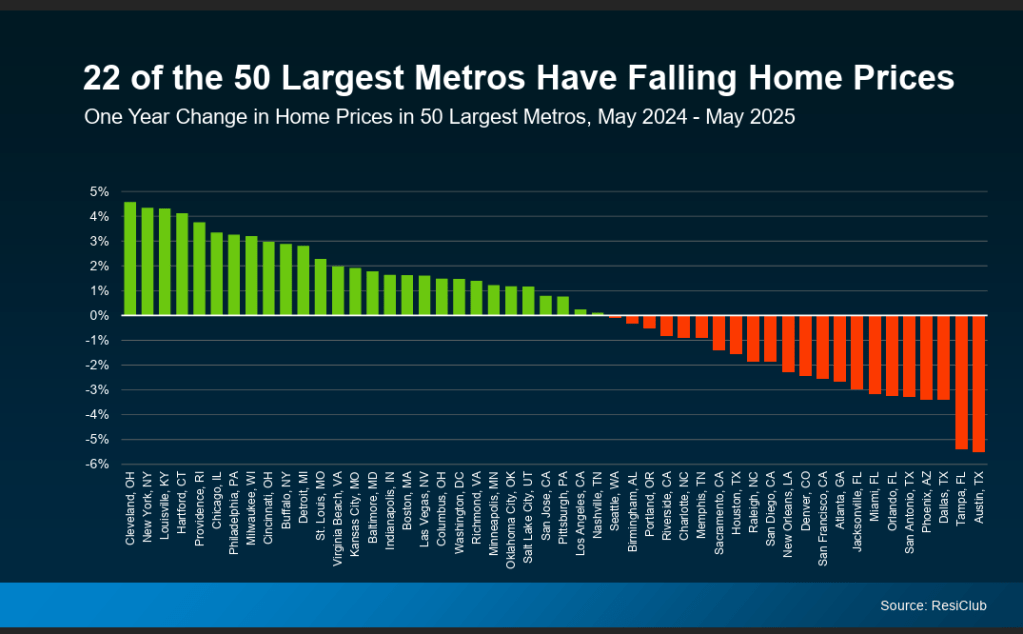

In that change, the Austin area has been dramatically affected:

In case you can’t read that slide on your device, you’ll find the Austin metropolitan area at the far right end of that chart with the largest year-over-year decline in home prices, second only to Tampa, FL.

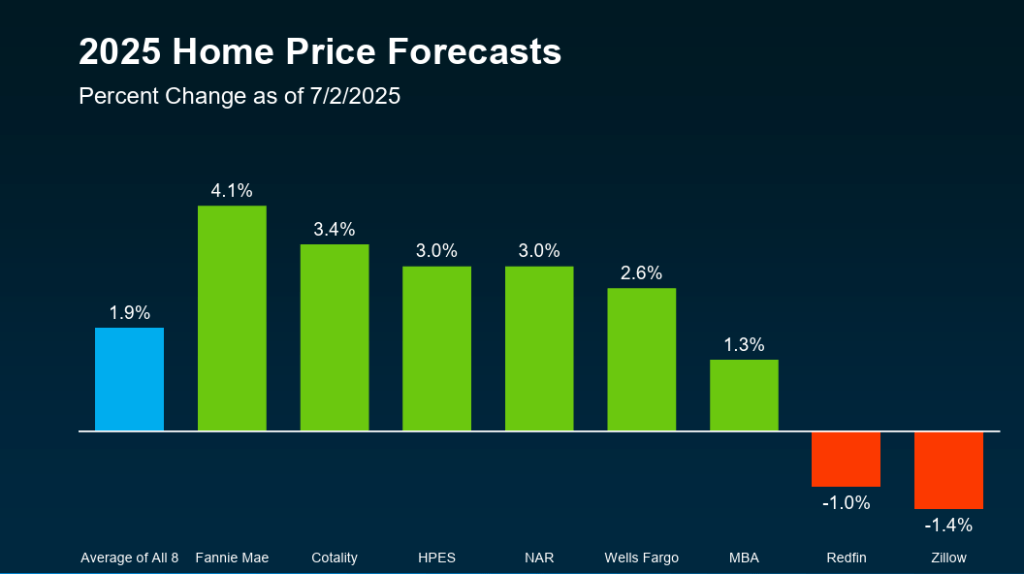

The forecast for the rest of the year is mixed:

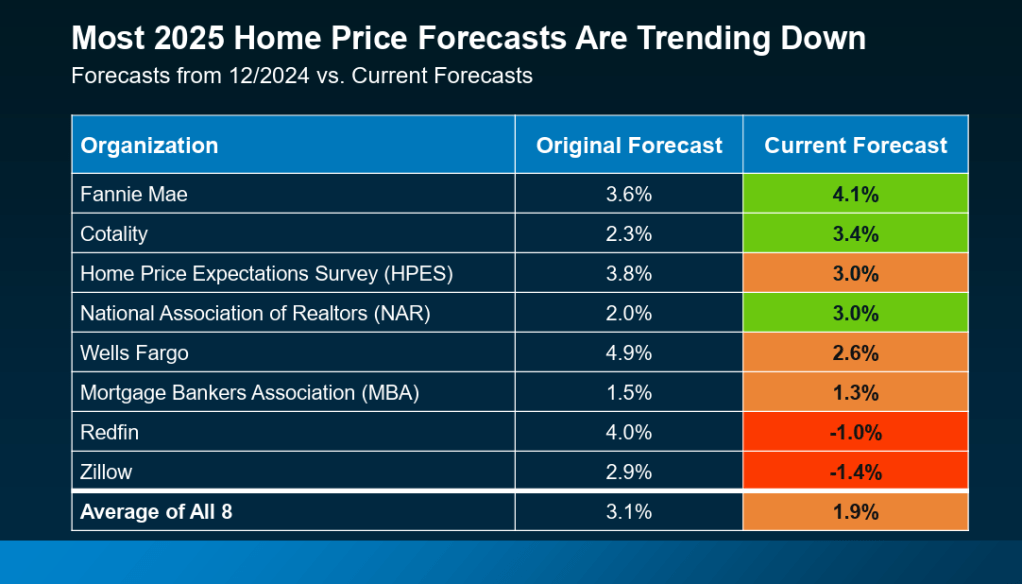

The average of all those forecasters is down compared to the beginning of the year:

Mortgage rates are expected to stay near their current levels, with the supply-and-demand imbalance likely to continue, so we’ll probably see today’s market environment continue for some time.

As I have provided ongoing market updates to my seller-clients in the Austin area, this situation has been visible, including the pricing challenge highlighted in the second chart above. Homes are selling but not robustly, and in some micro-market areas it is difficult to say with confidence that price adjustments will lead to changes showing and contract activity.

I’ll keep studying the market and reporting. Stay tuned ….

Discussion

Trackbacks/Pingbacks

Pingback: Austin Real Estate 2025: Market Shift Explained | Bill Morris on Austin Real Estate - September 12, 2025