I haven’t provided a comprehensive look at the Austin-area residential market since Timing and Pricing: Key Insights for Austin Home Sellers, but Jeff Osborne, broker/owner of Realty Capital City shared very important insights in a meeting yesterday that I want to share.

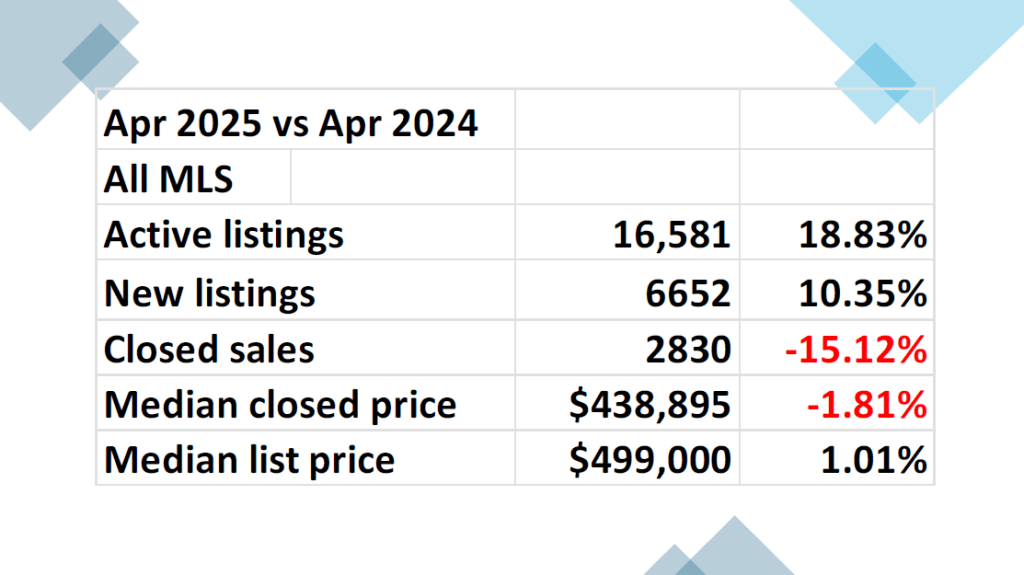

For the big picture, this chart says a lot:

The number of active listings in the metro area is at an all-time high, up almost 20% in April 2025 compared to one year earlier. Even with all that inventory for buyers to choose from the number of closed sales last month was down more than 15% compared to April 2024! Given that imbalance, it’s surprising that the median sale price was only down 1.8%.

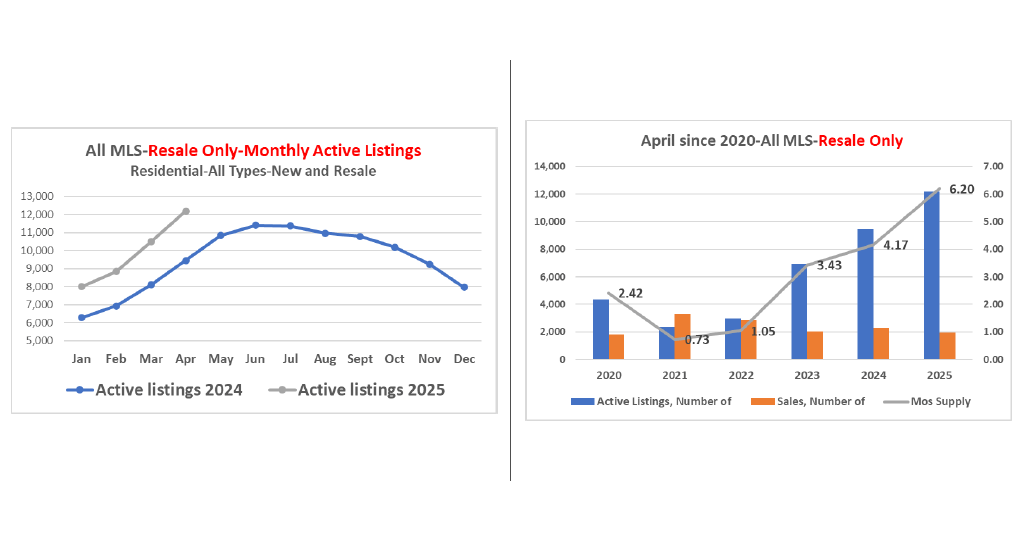

This graphic comparison of market conditions in each of the past six Aprils shows just how extreme this change has been. Compare the numbers of listings and sales in April 2020 versus April 2025:

These charts focus on just resale homes, and shows that resale inventory was above 6 months in April 2025:

That’s the highest “months’ supply” we’ve seen since August 2011! And notice the number of sales in each of the past four Aprils.

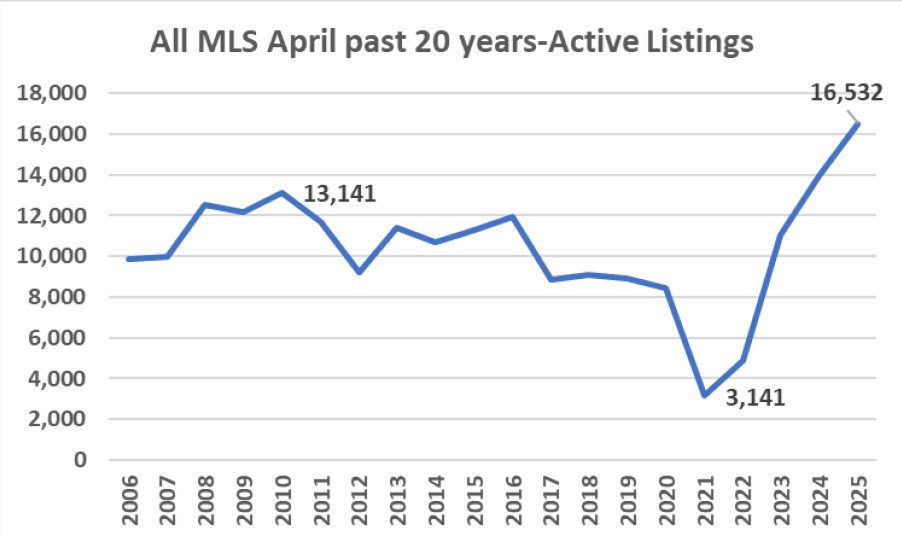

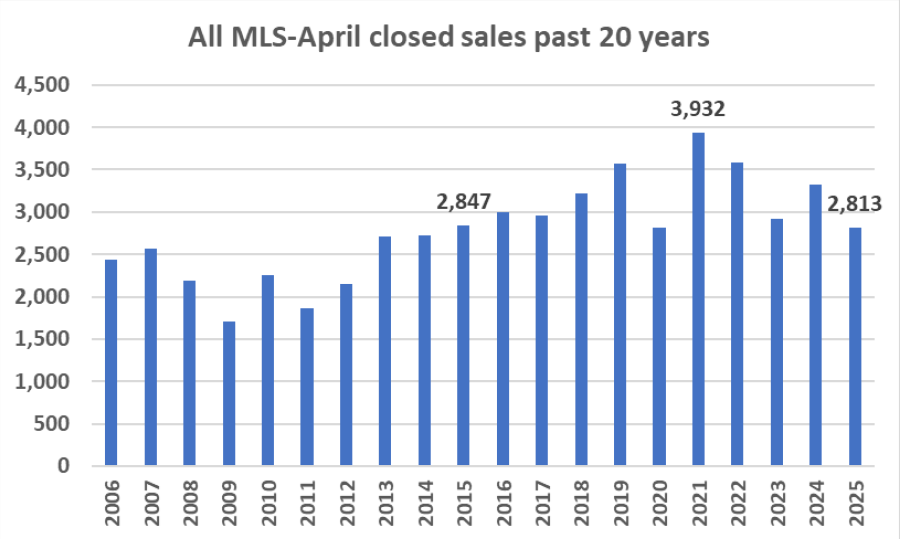

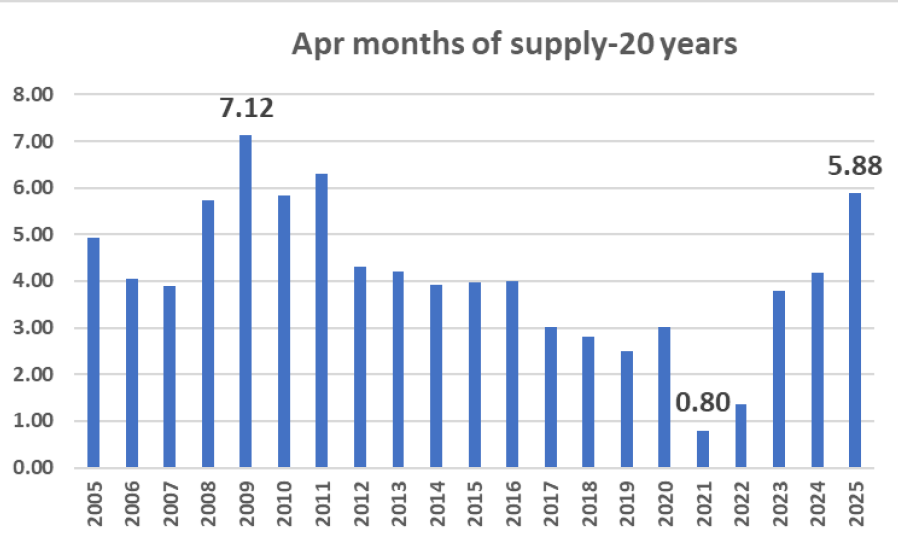

This 20-year view is even more surprising:

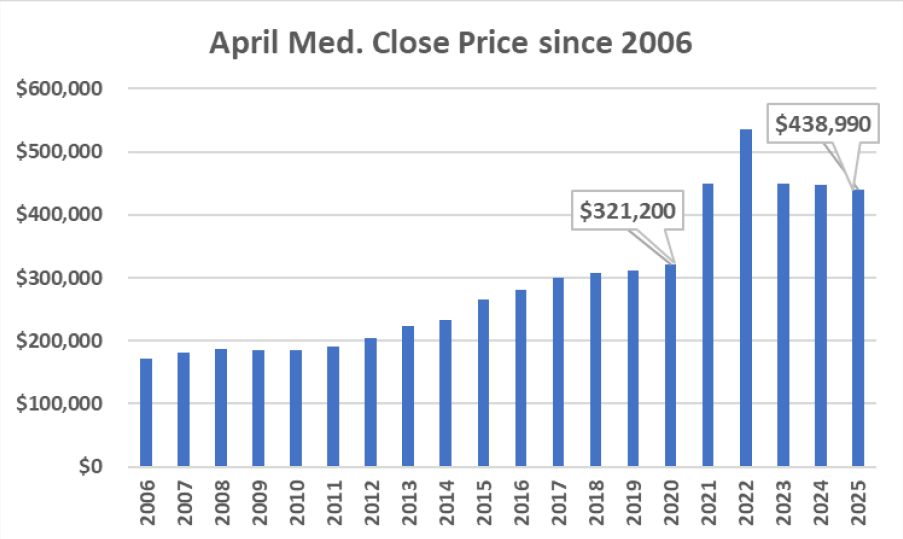

As I have pointed out before, 2006 was the peak of the last market cycle, and the following five years were widely considered the Great Recession. 2012 was the year we climbed out of that trough and entered the longest market cycle in memory.

There is an important difference between our situation now and what we saw in 2007-2011 — the significant equity that most homeowners in the Austin area gained over the past 5 years. There is no reason for us to see the tremendous foreclosure issues that were caused by the collapse of the mortgage business 20 years ago. Yes, owners who purchased homes in 2021 or since will be challenged if they have to sell, but those who bought in 2020 or before can still expect to sell for more than they paid and more than they owe.

What this does mean for all of us is that pricing now is more important than it has been in many years. (See Pricing Right Matters.) Buyers have a LOT of homes to choose from, and mortgage rates are about twice what they were for much of this market cycle. Broader economic and political uncertainties also complicate buyers’ decisions. Understanding this enviroment and acting accordingly is critical at this time. This is an adjustment for everyone, painful for some, but necessary.

Discussion

No comments yet.